- Biotechs have led the V-shaped market decline and recovery over the past 2 months

- A rise in M&A activity after a moribund 2018 has helped the sector to recover faster and positions it for further gains

- Low in-house R&D productivity and pressure on drug pricing create a difficult environment for pharmaceuticals and another reason for M&A

- Drug pricing regulation and greater political focus can hold back sector returns, although there will be many opportunities to outperform indexes.

- A portfolio comprising biotech companies with a promising pipeline will benefit from enhanced industry valuation if the M&A push is sustained.

Biotech Pulse

Biotech tumbled off a steep ski slope in the last quarter and at the December low the Nasdaq Biotechnology Index (IBB) had declined -28%, while the S&P Biotech Select Index (XBI) a whopping -36%. But it seems biotechs were able to regain their composure at the lows and ski gracefully higher during January in what now appears to have been a V-shaped two-month ride. Most likely, the pace of sharp run-up will now moderate out as it has offset the panic selling during December. In addition, the growing presence of familiar headwinds can prove to be a drag on the biopharma industries. Nonetheless, biotechs will continue to provide opportunities for robust gains.

Timely M&A Restores Confidence

In the Biotech Outlook 2019, published last December, we had mentioned that:

"Predicting a biopharma M&A ramp-up has become just as hard as predicting the results of a drug trial - totally uncertain...but, lower valuations may spark activity."

It was quite encouraging to see M&A activity in the biotechnology sector tick up measurably, right at the time when the sector needed a confidence booster. The rise in such activity to a significant extent explains why the biotech sector has led the market in the January recovery.

The biggest acquisition highlight was Bristol-Myers Squibb's (BMY) move to acquire biotechnology behemoth, Celgene (CELG). This was an acquisition of one of the top 4 biotech companies by market valuations. Only Gilead (GILD), Amgen (AMGN), and Biogen (BIIB) are bigger. There has not been this big a biotech acquisition for a very long time. Perhaps the market selloff in December contributed towards the final push to pull the trigger by Bristol on the $74 billion acquisition. The transaction did magic for the biotech sector and provided additional fuel to an emerging recovery.

A couple of days later, Eli Lilly (ELY) announced the acquisition of Loxo Oncology (LOXO) for $8 billion in cash, further sparking investor enthusiasm for biotechs.

Biotech M&A - The Anyday Now Narrative May Come True

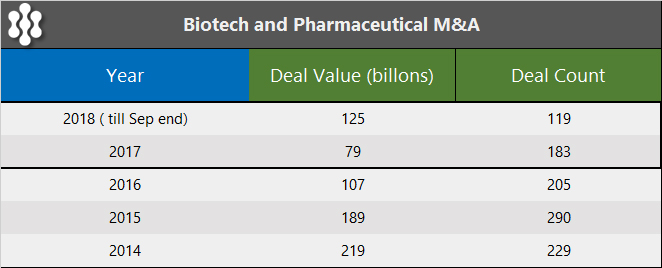

Acquisitions have remained a viable theme for the biotech sector for some time now driven by a number of compelling reasons, which include the lower R&D return for big pharmaceutical companies, the sizable cash holdings, and a promising and well-developed pool of target biotech companies further boosted by a record 56 IPOs in 2018. However, the transaction results have been disappointing in 2017 and 2018, as seen in the M&A activity table below.

The only reason 2018 showed an improvement over 2017 was due to a single large $64 billion acquisition of Shire Pharmaceuticals by Takeda.

With over $80 billion of deals announced in January 2019, it is not hard to envision that 2019 appears to be well-positioned to significantly surpass 2018 transaction value.

There are a number of companies whose names have been put forward as potential targets over the past year, and some of them quite frequently for a long time. A few of these include: Alexion Pharmaceuticals (ALXN) and Incyte (INCY) as large-cap biotech targets, particularly after the acquisition of Celgene; Clovis Oncology (CLVS) for its PARP-inhibitor, since Tesaro (TSRO) has now finally found a new home at GlaxoSmithKline (GSK); Amarin (AMRN) for its Vascepa rollout; Intercept Pharmaceuticals (ICPT) for its late-stage NASH asset, while Madrigal Pharmaceuticals (MDGL) and Viking Therapeutics (VKTX) for their mid-and-early-stage NASH products; Esperion Therapeutics (ESPR) and The Medicines Company (MDCO) for their cholesterol management late-stage assets; Acadia Pharmaceuticals (ACAD), Sarepta Therapeutics (SRPT), Heron Therapeutics (HRTX), which have been talked about as candidates for years like many others.

There are obviously many more companies which can fit the profile of an attractive target, and readers may build on this abbreviated list further in the Comments section.

There are a number of companies whose names have been put forward as potential targets over the past year, and some of them quite frequently for a long time. A few of these include: Alexion Pharmaceuticals (ALXN) and Incyte (INCY) as large-cap biotech targets, particularly after the acquisition of Celgene; Clovis Oncology (CLVS) for its PARP-inhibitor, since Tesaro (TSRO) has now finally found a new home at GlaxoSmithKline (GSK); Amarin (AMRN) for its Vascepa rollout; Intercept Pharmaceuticals (ICPT) for its late-stage NASH asset, while Madrigal Pharmaceuticals (MDGL) and Viking Therapeutics (VKTX) for their mid-and-early-stage NASH products; Esperion Therapeutics (ESPR) and The Medicines Company (MDCO) for their cholesterol management late-stage assets; Acadia Pharmaceuticals (ACAD), Sarepta Therapeutics (SRPT), Heron Therapeutics (HRTX), which have been talked about as candidates for years like many others.

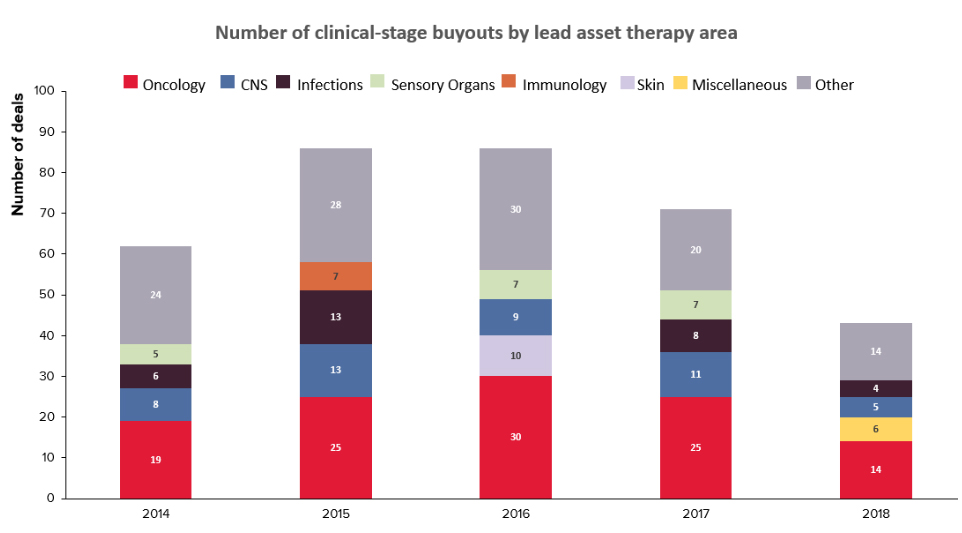

A recent analysis by Evaluate Pharma revealed that based on the historical data over the past 5 years, a majority of the buyouts have occurred for products in the Pre-clinical and Phase II stages.

The lower number of Phase III buyouts is understandable as such assets are also more scarce, besides being at a higher valuation, compared to the volume of assets available in Pre-clinical and Phase II.

The analysis also indicated that the leading therapy area for buyouts remains Oncology, as it has been for many years.

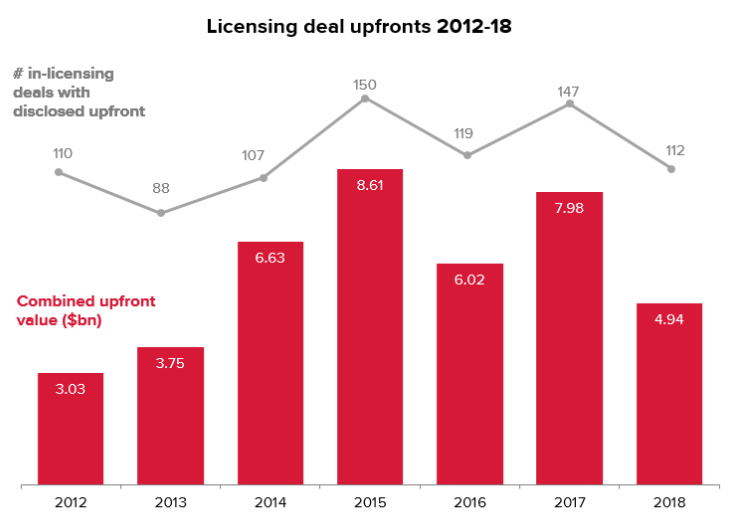

The recent slump in activity has not only been limited to M&A transactions but even licensing deals, which hit a five-year low in 2018.

The strong start to M&A activity in 2019, if it persists, may also contribute to spurring greater licensing activity this year.

However, buying a company just for its acquisition appeal can be a frustrating experience and even an ineffective portfolio strategy. A more prudent strategy would be to purchase promising companies for their product pipeline and expect M&A activity to lift valuations across the sector. In such a case, one may even get fortunate enough then to hold a company that gets acquired.

New Product Launches And Key Data Releases

The advancement of scientific frontiers has opened up new areas of exploration and opportunity to create potential blockbuster cures. This has attracted significant amounts of capital as evidenced by the number of biotechs receiving venture funding and the biotech IPOs - both setting records last year.

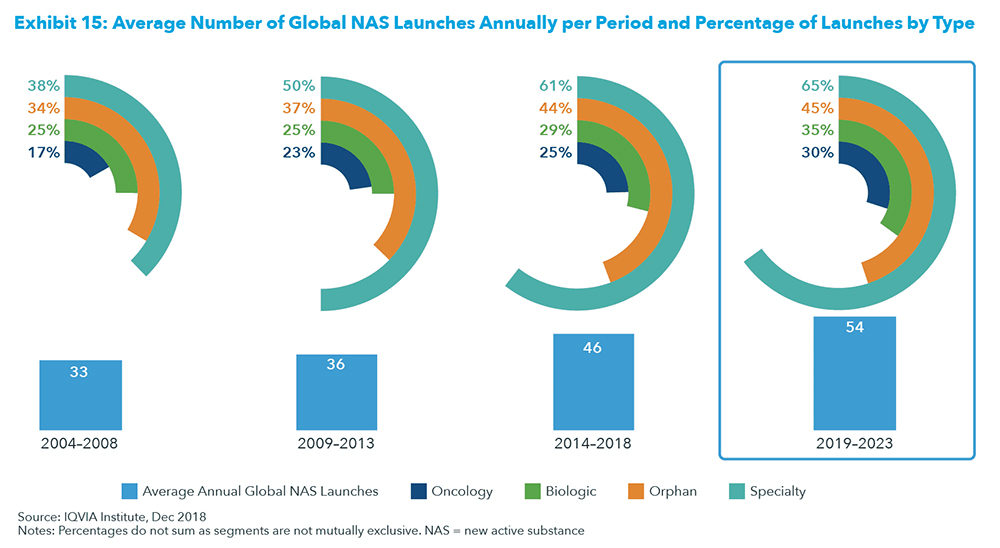

2019 is shaping up strongly for new data releases which can contribute towards a positive sector glow. In fact, the period 2019-2023 will have more new active substances or new drugs launched per year than at any time over a 5-year period since 2004.

As the above exhibit shows, on average 54 new drugs are expected to be launched per year for the next 5 years, compared to 46 drugs for the prior 5-year period.

In 2019 there are some key product launches, notably Alexion Pharmaceuticals' Ultomiris drug for rare blood disorder which was approved last December, and Kala Pharmaceuticals' Inveltys for post-surgery eye pain and inflammation.

Below is a table of a few key data releases and product launches.

2019 - Few Key Launches and Approval Decisions

| Product | Company | Event | 2024 Sales Est ($bn) | |

| 1 | Ultomiris | Alexion Pharmaceuticals | Approved Dec 2018 | 3.4 |

| 2 | Risankizumab | Abbvie | PDUFA Apr 25, 2019 | 2.2 |

| 3 | LentiGlobin | Bluebird Bio | EU - due Q2, 2019 | 1.9 |

| 4 | Zolgensma | Novartis | FDA - due May 2019 | 1.6 |

| 5 | Inveltys | Kala Pharmaceutical (KALA) | Launched Jan 2019 | 1.4 |

| 6 | Esketamine | Johnson & Johnson (JNJ) | PDUFA May 3, 2019 | 1.3 |

| 7 | Siponimod | Novartis (NVS) | FDA - due Mar 2019 | 1.3 |

| 8 | Selinexor | Karyopharm (KPTI) | PDUFA April 5, 2019 | 1.2 |

| 9 | Zanubrutinib | Beigene (BGNE) | China approval expected mid-2019 | 1.2 |

| 10 | Lumateperone | Intra-Cellular Therapies | PDUFA Sep 27,2019 | 1.0 |

| 11 | Roxadustat | Astrazeneca (AZN) / Astellas / Fibrogen (FGEN) | US/EU filing expected H1'19 | 1.9 |

Source: EvaluatePharma

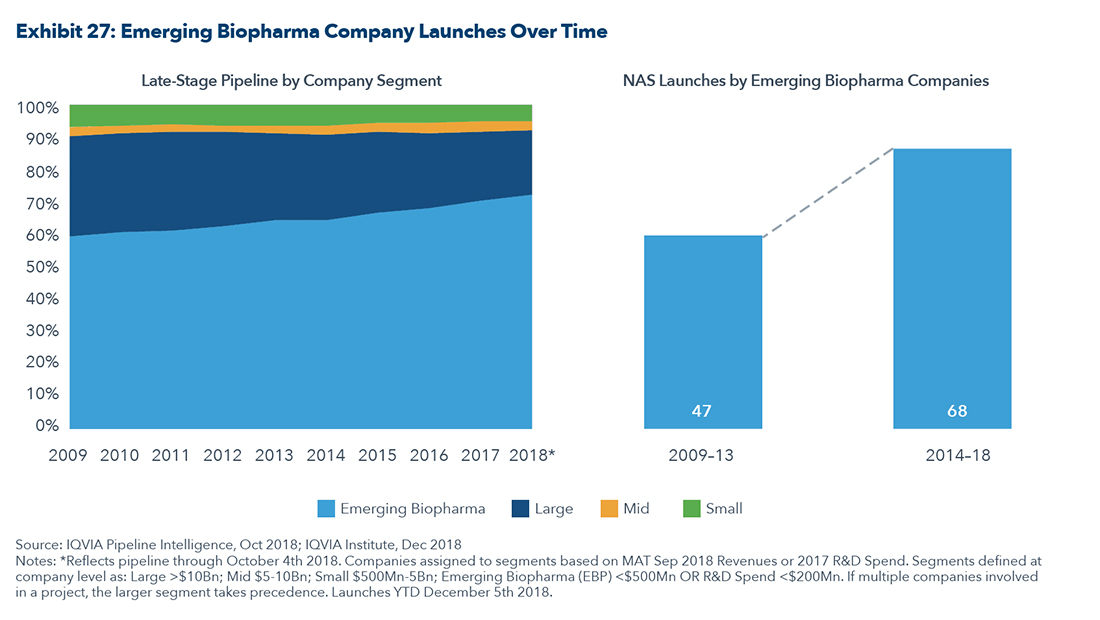

Much of the drug innovation is happening in the smallcap and midcap space with companies that have revenues of less than $500 million as shown in the graphic below.

This further strengthens the argument supporting M&A in the small-and-midcap space as the pharmaceutical companies strive to expand their pipelines with new compounds.

Regulatory Landscape To Become Noisier

As discussed in our 2019 outlook article, it is quite clear that with a Democrat control of the House, a President itching for a headline achievement on drug price reduction, and a warming-up battle for Presidential nomination, healthcare will receive more share of political attention than desired by the industry. The healthcare (XLV) sector faces the risk of constantly evolving regulations. However, the confluence of the above events creates a higher risk profile for pharmaceutical and biotech companies, similar to the one evidenced during 2015 and 2016, as the threat of drug price regulation remains a persistent backdrop to industry fundamentals. The biotech industry depends on the pharmaceutical industry for its eventual high-valuation exit. So what's good for the pharma industry is often good for biotechs.

The House Committee on Oversight and Reform showed the priority of the drug pricing issue in its agenda by holding its first hearing of the 116th Congress on the subject of prescription drug prices. The President's remarks at the State of the Union on lowering drug prices were quite clear as well. Half-a-dozen bills have been introduced just over the past few months to target drug pricing using different approaches.

Drug cost is an issue that resonates strongly with Americans and consistently ranks as the biggest health care concern. It is an issue with decent bipartisan support, and that itself is notable in this divided Congress.

Could there be a grand bargain between the President and the Democrats on this issue?

It's possible. But at this juncture unlikely as the Democrats launch multiple investigations on the President's activities which may create an even more uncompromising environment in the government. Any other proposed healthcare legislation by the House will need Republican support in the Senate. That's possible but again a low probability outcome.

So most of the bills may not end up as legislation and be just noise. But, the hearings and the process can still be quite uncomfortable for the industry and investors.

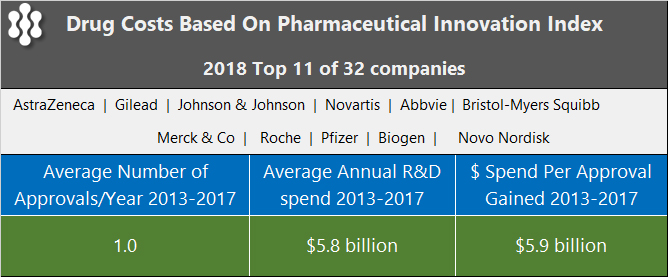

In this debate, it will be helpful to also understand the cost of developing a drug for large pharmaceutical and biotech companies. It is well-known that for each drug that is approved, the number of drugs that end up failing is many times over. So the average cost of a single approved drug to a large pharmaceutical company can be viewed as the size of their R&D budget (success + failures) over the years spread over the number of approved drugs. Data indicates that an approved new drug can potentially cost $6 billion after looking at the spend on R&D failures, as we discuss further in the next section.

Pharmaceutical Companies In A Pincer

The pharmaceutical companies are in a pincer, caught between lower R&D productivity and rising backlash on prices.

On the one hand, they need to make aggressive moves to create new product lines to prepare for the day when their blockbuster franchises begin to erode. For some pharma, such a day is approaching fast if not already here. While on the other hand, the massive in-house R&D expenditures are not delivering a sufficient return on the capital being deployed.

Recently, an interesting statistic caught our eye in an article by Idea Pharma, a pharmaceutical consulting company, about the estimated cost of a drug. The firm maintains a Pharma Innovation Index and used the data for the top 11, out of 32, companies over a 5-year period from 2013 to 2017 to arrive at the numbers below.

The conclusion was that new drugs are unable to cover the costs of failures within the pipeline.

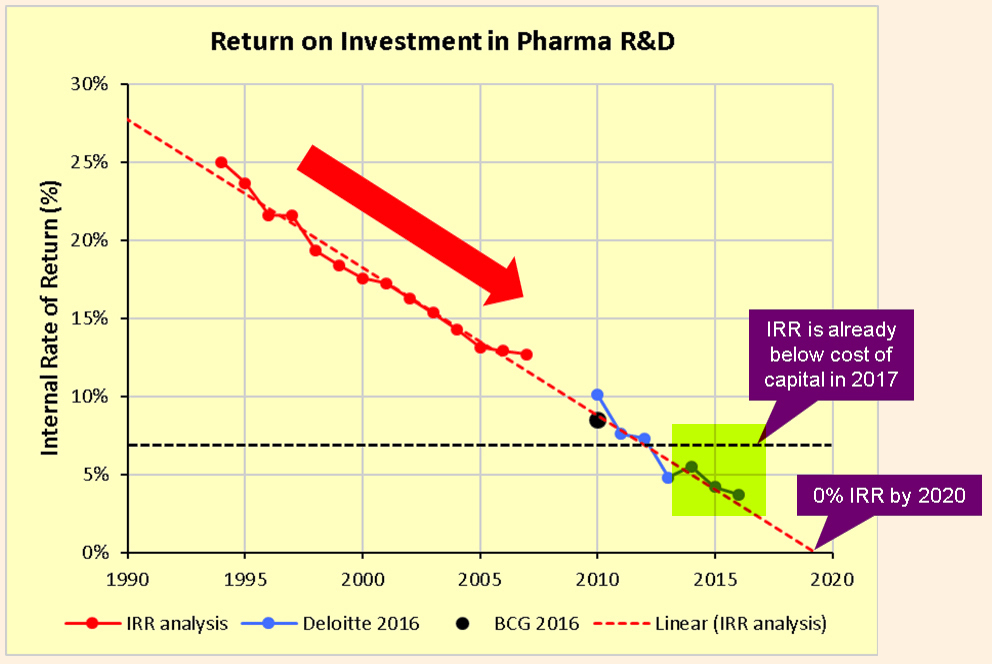

Pharmaceutical companies are struggling with a drug development model where the Internal Rate of Return ((IRR)) on the significant R&D expenditures has been steadily declining. Last year, we had highlighted the issue of low Return on Investment ((ROI)) on R&D budgets. Already believed to be in the low single digits, the IRR runs the risk of heading towards zero and perhaps worse by 2020. These were the insights from a compelling analysis by industry writer Kelvin Stott as well as prior analyses by consulting firms Deloitte and the Boston Consulting Group.

There are many reasons for this decline in IRR, including rising clinical costs, regulatory environment, pressure from insurers, and generic competition. But one of the key reasons is the scarcity of opportunities to create blockbuster drugs, and as Stott explained, the law of diminishing returns which makes it harder for the industry to create the next blockbuster that can surpass the previous one.

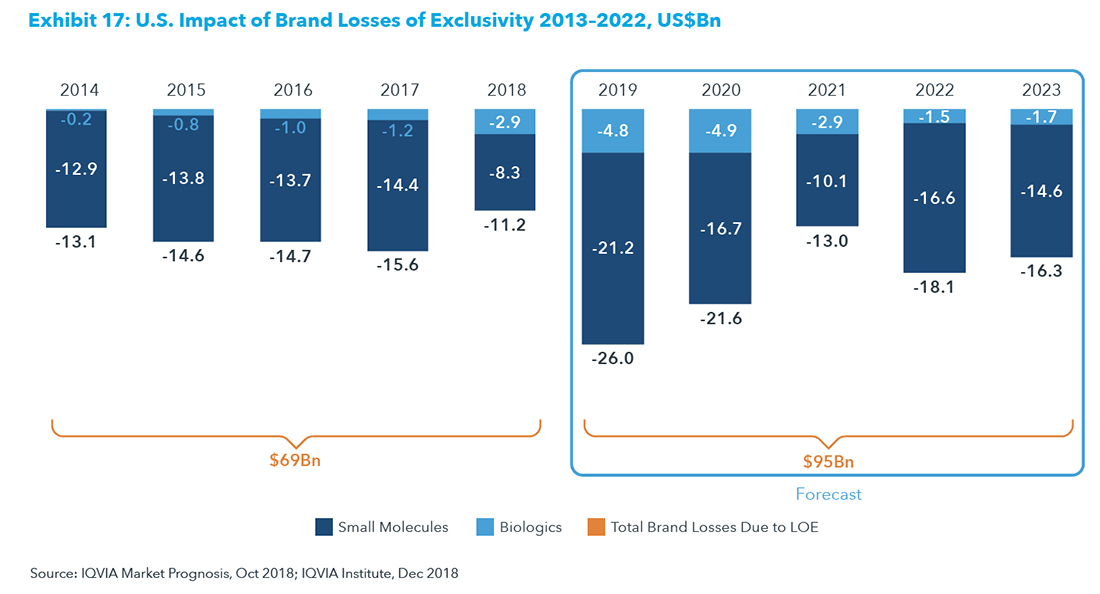

Pharmas are being forced to invest in greater innovation to reverse the decline in IRR. The new science around immunotherapies, personalized medicine, gene editing, regenerative medicine, etc., create opportunities for future blockbusters, while the existing money-makers are looking at shrinking revenues as they begin to compete with biosimilars and generics. A pharmaceutical research firm, IQVIA Institute, estimates that over the next 5-year period from 2019 to 2023, brand losses from the expiration of exclusivity will reach $95 billion, well ahead of the $65 billion over the prior 5-year period.

All this is happening at a time where there is also a growing push toward managing drug prices. Declining ROI on R&D budgets, cash cows under threat due to patent protection expiration, and growing pressure on the top line as the clamor for drug price control gets louder, is a difficult conundrum that the industry now faces.

If the cost of drug development is so high, it becomes an unrealistic expectation to regulate drug prices and at the same time not affect product development adversely. The high drug prices are not just an isolated single-factor issue but a more systemic issue that requires a broader solution and not only one that solely targets drug price regulation. Any regulation activity needs to perform a careful balancing act to achieve the twin goals of lower drug prices and strong new product development.

Eventually, M&A Activity Should Benefit

Can M&A be one of the keys for big pharmaceuticals to expand their pipeline of innovative products and in-turn boost the flagging rate of return on product development?

Very much so!

The high total cost of drug development can become an existential question on the health of pharmaceutical companies as we cross over into the next decade. The declining return on in-house R&D will continue to create pressure on the pharmaceutical companies to a point where they are forced to broadly expand their M&A effort with renewed urgency.

Perhaps, 2019 may well become the year when transaction activity begins to ramp higher. And when it does, it cannot be a one-year event but the beginning of a sustained consolidation period recasting the industry dynamics.

Conclusion

The best way to be positioned for rising M&A activity in biotechs will be to have portfolio exposure to the sector. After all, if the M&A pace sustains, then a rising tide will lift all boats. A mix of promising companies across the market cap continuum can have an advantage of even being potential M&A targets. Building out just an acquisition-driven portfolio doesn't work out most of the time. Many potential hot acquisition targets have been waiting for a long time. The SEC filing associated with the December 2018 acquisition of Tesaro (TSRO) by GlaxoSmithKline is an interesting read on the lengthy attempt to auction off the company since mid-2017, finally finding success over 18 months later at a much lower valuation.

The biotech indexes have got off to a strong start this year, after a nerve-wracking ending in 2018 which saw the group amongst the worst performers during the market slide. For the full year 2018, the Nasdaq Biotechnology Index (IBB) was down -10% and the S&P Biotechnology Select Index (XBI) was down -15%. The Prudent Biotech Portfolio was up +27% over the same period. As of this Friday, February 8, the biotech indexes had double-digit gains for the year.

Biotech fortunes can change often and on even a small data readout. So one has to keep refreshing the watch list and biotech exposure in the portfolio. A few promising biotech companies, some of which may be now or in the past part of the Prudent Biotech model portfolios, include Vertex Pharmaceuticals (VRTX), Exelis (EXEL), Regeneron (REGN), Incyte Corporation (INCY), Amarin (AMRN), Intercept Pharmaceuticals (ICPT), Fibrogen (FGEN), Sage Therapeutics (SAGE), Denali Therapeutics (DNLI), Array BioPharma (ARRY), Arena Pharmaceuticals (ARNA), Acadia Pharmaceuticals (ACAD), Blueprint Medicines (BPMC), Codexis (CDXS), Global Blood Therapeutics (GBT), BioCryst Pharmaceuticals (BCRX), Uniqure (QURE), Biohaven Pharmaceutical (BHVN), GW Pharmaceuticals (GWPH), Vericel Corporation (VCEL), Mirati Therapeutics (MRTX), Ra Pharmaceuticals (RARX), Arrowhead Pharmaceuticals (ARWR), and Agenus (AGEN). Sector exposure can also be acquired through heavily diversified ETFs like IBB and S&P Biotechnology Select (XBI). In addition, there are higher-risk, leveraged ETFs for bullish (LABU) and bearish (LABD) outlooks.

Once again, take a portfolio approach in biotechs to overcome mistakes. Next week a hopeful budget resolution and positive updates from the visits to China by trade negotiators can assist stocks in maintaining the uptrend.

Author's note: As always, kindly do your own due diligence.

The article was first published on Seeking Alpha.