Biotech Pulse

For the past year, we have written about how biotech stocks, even with their promising prospects, remain weighed down by concerns about soaring yield and that valuations will advance when the 10-year yield has peaked. That time has come and prospects have significantly improved for biotechs to move sharply higher in the final few weeks of the year.

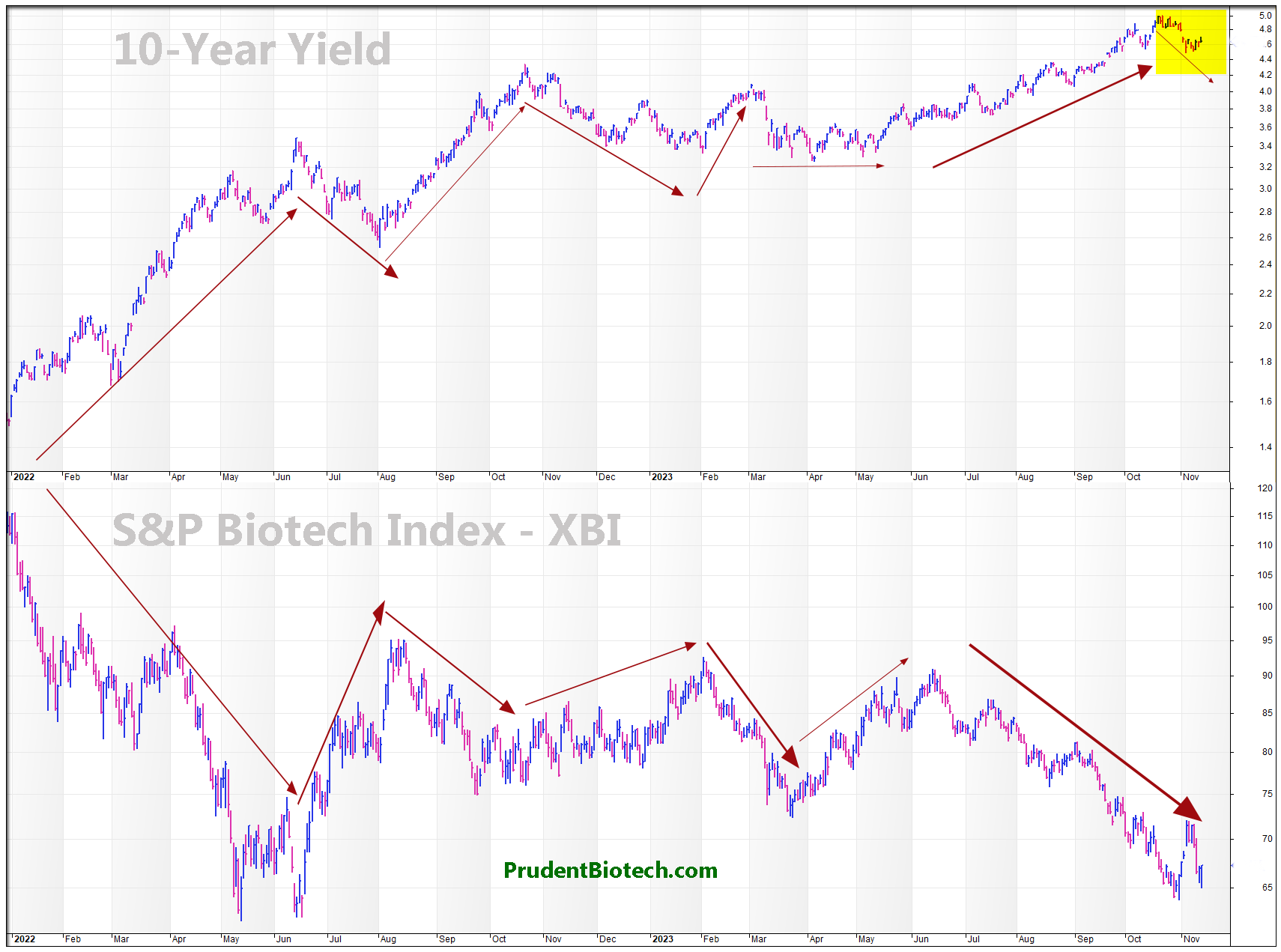

Biotech Valuations Tethered to 10-year Yield

Rising long-term yields make it harder for stocks, particularly higher-risk growth stocks and speculative industry groups, to compete against a relatively risk-free asset, since potential future earnings are now discounted at a higher rate.

Biotechnology valuations are highly correlated to the performance of the 10-year yield, which plays a crucial role as the preferred discount rate for valuations. A robust negative correlation exists between the yield curve's trajectory and the fortunes of the biotech industry.

As one will observe in the above chart, even though yields have dropped since the Federal Reserve's rate decision on November 1, the biotech valuations have not yet moved higher. The probability of the yields likely peaking is much higher at this point, but biotech valuations have not yet reflected that shift in expectations.

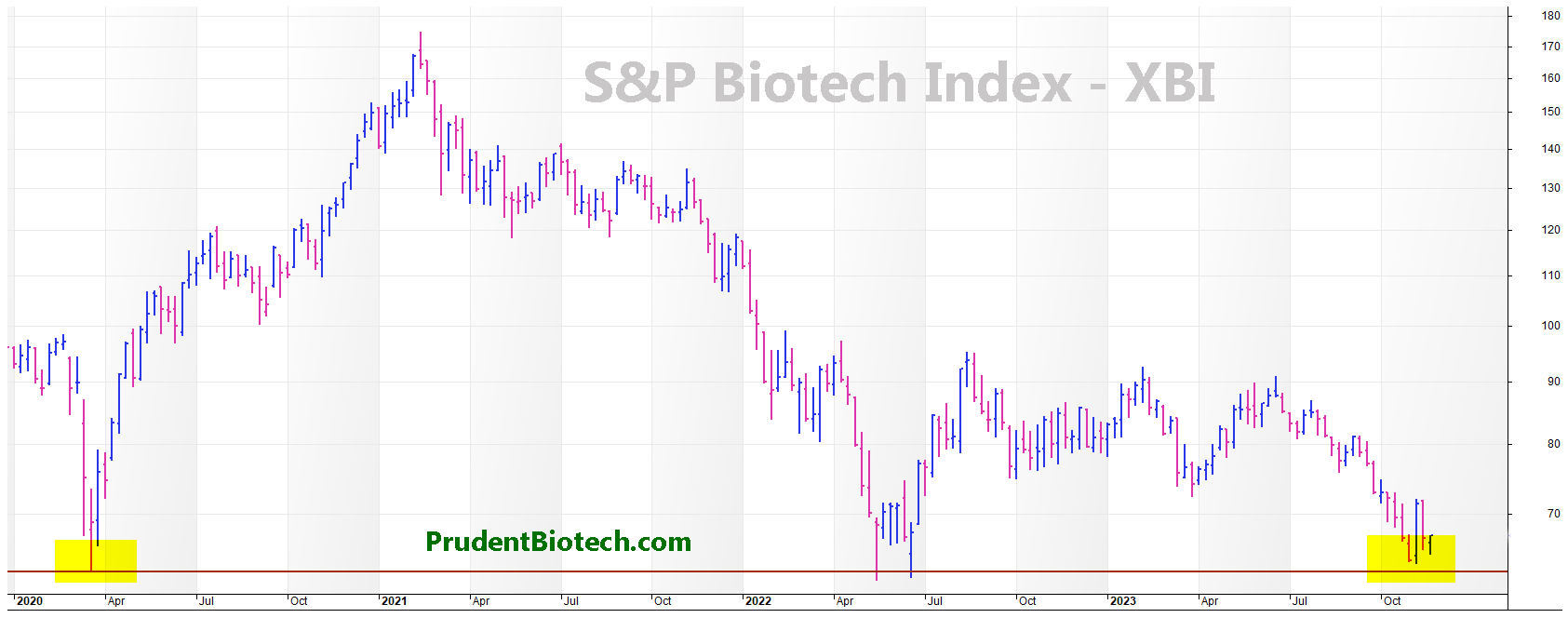

Such has been the misery of the biotech industry group over the past two years that the S&P Biotechnology Index (XBI) is trading at levels reached in 2020, during the height of the pandemic. Low relative valuations with a shift in interest rate environment can be strong catalysts for a rapid rise.

Conclusion

The 10-year yield curve has been in an uptrend since April of this year, soaring to a high of 5% in late October. Yields have pulled back after the Federal Reserve indicated a patient approach towards further hikes and economic data showed a deceleration in the pace of new hiring.

After a two-year consolidation, biotech stocks can see a more favorable environment for the remainder of the year if yields can continue to trend lower. While the 10-year yield can rise again, the probability has grown that it has likely peaked, at least for the next few months. The drag from a restrictive monetary policy will only increase with each passing month thus further bending the economic data to favor lower inflation and lower longer-term yields. Thus, low relative valuations, an improving risk environment, potential M&A, and a lengthy consolidation period, position the biotech group better than at any other time this year for a forceful advance, spurred by a change in investor sentiment towards riskier assets.

The investment exposure in the Prudent Biotech model portfolio was raised to 100% earlier this month and the biotech exposure in the Prudent Healthcare portfolio was raised to 30%. Several biotech companies appear promising and a few of them, which can be already part of the Prudent Biotech, Prudent Healthcare, or Prudent Small Cap portfolios, include Vertex Pharmaceuticals (VRTX), BridgeBio (BBIO), CymaBay Therapeutics (CBAY), Rhythm Pharmaceuticals (RYTM), Nuvalent (NUVL), Ideaya Biosciences (IDYA), Blueprint Medicines (BPMC), Apellis Pharmaceuticals (APLS), Arcellx (ACLX), and Crinetics Pharmaceuticals (CRNX).