Healthcare Pulse

In 2023, the healthcare sector remained in a defensive crouch ending the year with a flat performance while the broader market surged. The sector was a haven for investors during 2022 but faced headwinds in 2023 as it had trouble gaining momentum, particularly with three of its major industry groups - pharmaceuticals, medical devices, and biotechnology - struggling at various points during last year.

In the 2023 outlook last year, our expectation was for the sector to perform a little more robustly, and we had noted that:

"The first half could be chaotic and thus, defensive healthcare industry groups can continue to remain attractive. However, growth stocks are going to be sought as the year matures. We anticipate the broader healthcare sector to perform better in the first half, but likely not in the second half...when the group will more likely be driven by individual stock performances than by a rising tide for the whole group. For the year, we expect the broader S&P Healthcare Index to rise 10%."

The S&P Healthcare Index ended at the same level as it started in 2023, while the S&P 500 rose 24%. Our expectations were off as a result of some unique situations discussed below.

Healthcare's Path in 2024

In the first half, we foresee the healthcare sector capitalizing on its defensive attributes to counter the material risk associated with a potentially slower Federal Reserve rate-cut timetable than present market expectations. Pharmaceuticals, insurance, & managed care groups are expected to be strong performers in this period. Later in the second half, growth-oriented industry groups, including medical products, devices, and services, are likely to lead as the momentum for rate cuts builds up. Biotechnology, in particular, is poised to shine if the 10-year yield stays below 4%.

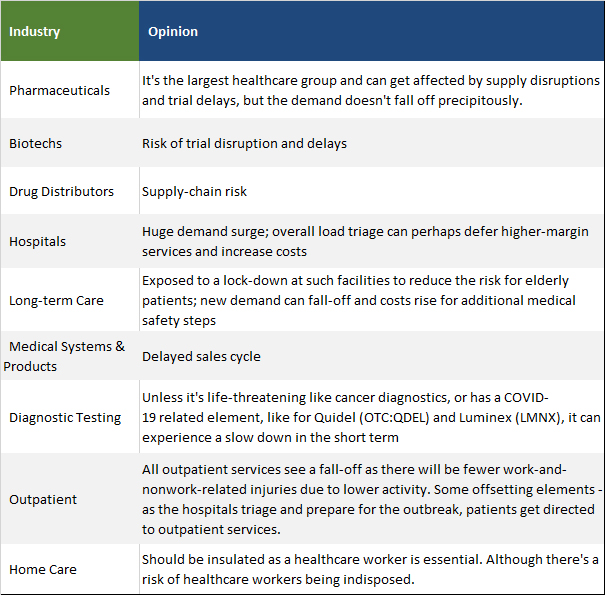

Pharmaceuticals

Pharmaceuticals, the largest healthcare industry group by market capitalization, experienced mixed performance in 2023. While companies like Eli Lilly thrived due to a robust new product pipeline, others like Pfizer struggled with limited pipeline successes and declining sales. The pharmaceutical industry has to navigate some major challenges this year, of which the most prominent is drug price regulation.

As part of the Inflation Reduction Act, the Center for Medicare & Medicaid Services (CMS) gained the authority to negotiate prices for Medicare in 2024. The process started last year with the identification of ten drugs in the first round. The price negotiations will begin on February 1, when the CMS offers its initial "maximum price." The CMS will make its final price offer on July 15. If the drug manufacturer refuses to accept the price, the drug will no longer be covered under Medicare and Medicaid, and there will be a steep excise tax on the U.S. revenues of the drug. The issue is in the courts with decisions to start coming mid-year.

The drug price negotiation is the first time the industry is facing such a forceful challenge on high drug prices, leaving it potentially grappling with lower prices, lower revenues, and lower profit margins. Favorable court judgments can spark a strong rally in pharmaceuticals and biotechs.

The drug price negotiation is the first time the industry is facing such a forceful challenge on high drug prices, leaving it potentially grappling with lower prices, lower revenues, and lower profit margins. Favorable court judgments can spark a strong rally in pharmaceuticals and biotechs.

In a further challenge to higher prices, the Food and Drug Administration [FDA] last Friday issued its first approval for the mass importation of drugs when it authorized Florida to import directly from wholesalers in Canada, where the prices are lower. This is a major policy shift overcoming decades of fierce opposition from pharmaceutical companies. Other states have also applied to the FDA for similar bulk imports to cater to the state's various healthcare programs, including Medicaid, government clinics, and correction facilities. The industry association is expected to file a suit shortly to block the program.

Drug pricing remains a major healthcare issue in the country and presents a unique and difficult challenge for the pharmaceutical industry this year. The issue is likely to cast a long shadow over the pharmaceutical and larger biotech companies and can prove to be a damper on valuations as the year progresses.

Biotechnology

Biotechnology, the largest healthcare industry group by number of companies, faced a challenging 2023 as the benchmark 10-year Treasury yield surged. However, the group rebounded in the final months of last year to post an annual gain of 3%. Biotechnology is positioned to be one of the best-performing healthcare industry groups for 2024 and is explored in greater detail in the article Biotech Bonanza: 2024 Outlook.

Medical Devices, Systems, and Services

The medical devices and products industry struggled in 2023. Besides the typical challenges for growth companies in a rising yield environment, the group was adversely impacted by the success of the GLP-1 weight-loss treatments, due to the implications of a shrinking market for health conditions where obesity is a major contributing factor - like diabetes, liver diseases, and cardiovascular health. The medical products group declined sharply from indiscriminate selling on the fear of less demand for stents, knee replacements, heart attack and stroke treatments, etc., in the future.

This issue will persist going forward, though it is hard to predict the timing and size of the impact the issue will have on the market opportunity. We believe the broad-based decline in the group will be replaced by more targeted declines in individual companies who are found to be more heavily exposed to such shifts in health paradigms.

Innovation and advancements in technology continue to expand the opportunities for these industry groups. Solutions that address the growing demand for health care, address ongoing supply chain challenges and labor shortages, reduce costs of delivering health care, and improve efficiencies, continue to drive health care spending. Home-based care providers should also perform well due to the aging demographic.

Outlook

Healthcare is a strong defensive sector with pharmaceuticals, hospitals and managed care, and health insurance companies providing steady visibility on earnings growth during periods of market stress. We may encounter such a period of high volatility during the first half if the Federal Reserve starts to walk back market expectations of a rate cut in March 2024.

If the 10-year yield remains below 4%, we are likely to witness biotechnology and growth-oriented medical products and services stocks do well. We continue to believe portfolio exposure to the biotech group should serve investors well this year.

We expect the S&P Healthcare Index (XLV) to gain 5% to 10% this year, held back by issues around drug price control. We anticipate that biotechs will be one of the best-performing healthcare groups, positioned to deliver returns of 20% to 25%, as discussed in the biotech outlook.

There are several healthcare companies positioned to do well. Some of these, which may already be part of the Prudent Healthcare or Prudent Biotech portfolio, include Elly Lilly (LLY), Novo Nordisk (NVO), Merck (MRK), Gilead Sciences (GILD), Vertex Pharmaceuticals (VRTX), Moderna (MRNA), Natera (NTRA), TransMedics Group (TMDX), Twist Bioscience (TWST), Amphastar Pharmaceuticals (AMPH), Immunovant (IMVT), Elanco Animal Health (ELAN), Collegium Pharmaceutical (COLL), and RxSight (RXST). More biotech companies and insights are provided in the biotech outlook article.

A major industry event this month is the J.P. Morgan Healthcare Conference from January 8-11. It is the largest healthcare investment symposium providing industry insights and setting the healthcare investment tone for the year. It is often used as a platform for corporate news releases including trial results and M&A.

This outlook expectation is simply a general framework to guide investors about the potential of the healthcare sector and will need to be adjusted if market conditions deviate materially from current expectations.

The article was first published on Seeking Alpha.