Healthcare Pulse

A new reality dawned as the stock market entered a bear market.

It wasn't a tiptoe moment for the bear. The market simply plummeted into a bear market canyon. Just from March 4 to March 12, in about a week, the S&P 500 and Nasdaq declined 20% or more. The healthcare index did relatively better during that period, declining -17%, though still a painful performance.

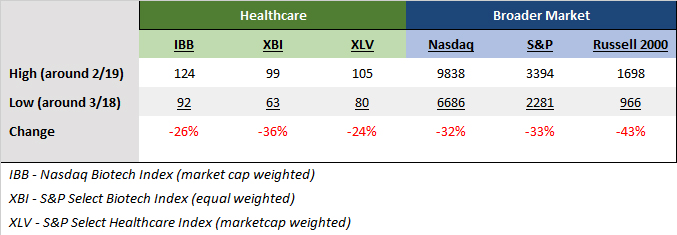

However, this was the good part. The pullback as measured from recent highs is even worse. The table below shows the depth of the pullback and the extent of the damage.

One thing that stands out is that the healthcare index (XLV) has retreated relatively less than the broader market. Even the larger-cap weighted Nasdaq Biotech index has held its own, outperforming the market meaningfully, while the smaller-cap weighted S&P Biotech has declined around broader market levels and much better than the Russell 2000 index. There's a preference for well-capitalized large-cap biotechs.

An Economic Morass

The viral pandemic is triggering a shutdown of the economy. This shutdown is picking up its pace and now sweeping across multiple sectors of the economy, akin to closing hatches before a submarine dives. The extent of the damage is unknown but will most likely be severe though short term. A typical recession unfolds over many months triggered by a tightening monetary policy and a loss of consumer confidence. Consumer spending begins to slow and so does production. However, event-driven recessions have different dynamics, and none so pernicious as this pandemic-driven one. Consumption plummets in a matter of weeks. Production plummets in a matter of weeks. Labor participation plummets in a matter of weeks. Cash flows that lubricate the wheels of the economy simply vaporize for most industries and fixed costs begin to crush businesses. This happens as debt service and covenants come due. Access to liquidity or cash becomes a question of survival. Such things happen during a typical economic recession too, affecting different sectors with varying degrees of intensity like it did during The Great Recession. At that time, it was the financial sector that imploded. But it doesn't happen to a majority of the sectors in the economy in a rapid and synchronized retreat like it's happening now. There were more than 80 million hourly workers in the US in 2017, the last year from which data is available, as per the US Bureau of Labor Statistics (BLS). Needless to say, a number of them could be feeling pressured very quickly as their work hours shrink or disappear

Federal Reserve To The Rescue

The Federal Reserve can't fight the virus directly. But it can blunt its devastating economic consequences. The primary job of the Federal Reserve at this point is to limit the damage to the economy rather than the typical jump-starting it. It has to ensure that most of the businesses are preserved when things begin to turn around by most likely April end. And the Federal Reserve is doing that with rapid action, whether it's cutting rates or ensuring liquidity in the banking system or encouraging borrowing. Such interventions will continue and get more creative and coordinated for the crisis warrants such actions.

Time Is The Biggest Enemy

As is clear with the viral spread, time is the biggest enemy. This also is true for fiscal and monetary action. The Federal Reserve realized the urgency and moved swiftly in what was one of the biggest rate cuts ever done - 150 basis point in a week. The central bank also is deploying its balance sheet as a backstop to the credit markets.

The government needs to realize that as well that time is the biggest enemy. And it can't pick and choose now which industry receives a bailout or rescue package. That process will take too long, require too much buy-in from various constituencies, and much opposition to overcome. And the fact is that there will be just too many situations warranting a bailout or rescue.

As mentioned in our previous article, What's Ahead For The Stock Market, the Federal Reserve and the Federal Government need to set up zero-rate loan facilities that can allow businesses, big and small, to borrow based on uniform criteria. A bridge facility to tide over the crisis. This should contribute toward preserving consumer confidence, beyond the one-time $1,000 hardship bonus, that there will be jobs to go back to.

Incremental help is no longer an option. Remember when President Trump was talking about needing only $2 billion and now it is $1 trillion in a few days. There's a lesson in it - this is now a very fast-moving crisis as the delayed containment efforts have failed miserably and getting ahead of it requires bigger actions earlier.

Healthcare Moving In The Right Direction

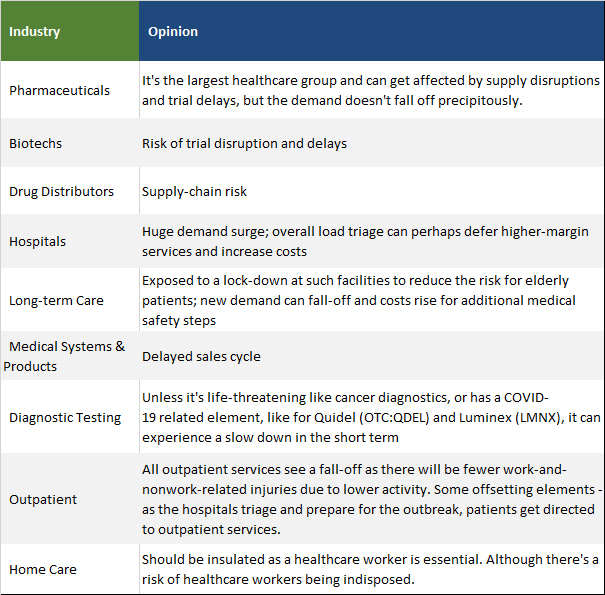

Healthcare came into the year already facing high regulatory uncertainty. Besides a growing unease at climbing healthcare costs, the pharmaceutical industry also was facing a growing backlash against drug price increases. Democratic candidates for the presidential elections had made healthcare restructuring a central part of their policy portfolio.

Two plans emerged, which were referred to as Medicare for All and Medicare for All with a public option. While both plans are quite sweeping and progressive compared to the status quo, solely from an investing perspective, the Medicare for All plan has a relatively higher risk profile for investors as it would recast the industry structure and create a single point of healthcare payment. Earlier this month, the Medicare for All plan appears to have lost traction as the primary proponent of it, Sen. Bernie Sanders, lost the front-runner status in the nomination race. That was a significant risk-diminishing event for healthcare.

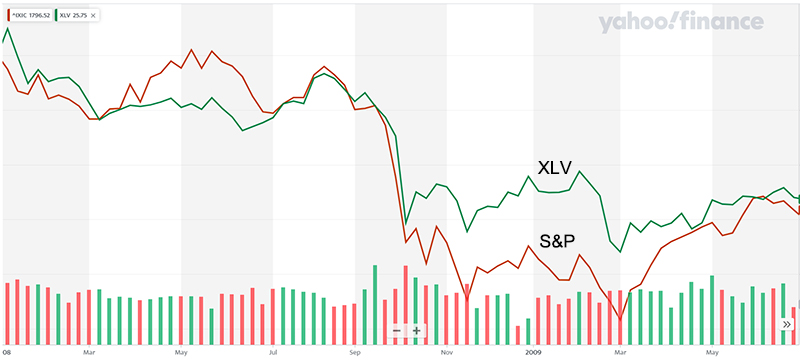

Healthcare is a defensive sector. In times of economic stress, it can tend to outperform the broader indexes on a relative basis. The sector still declines, but relatively less than the S&P 500. Its relative performance in the last recession is shown in the chart below.

At this time one of the key risks to biotechs is the same as the one that confronts all companies and the economy - access to liquidity and working capital.

With the public market window for offerings closed, biotechs will have to rely on existing resources. However, the risk of a biotech credit crunch is relatively much less since financially their balance sheets are much stronger today than even perhaps at any other time since the Great Recession. The ability of biotechs to sit out the crisis and continue with their work is relatively superior simply because in most cases the entire funding of operations is balance sheet-driven and not cash flow-driven. To the extent the balance sheets are weak, there will be financial stress, and such companies will have to cut expensive deals in private placements with investors. Lower cap companies may be ignored as investors prefer the security of larger-cap biotechs. But biotechs as an industry group will not encounter a meaningful liquidity crisis compared to other sectors of the economy.

A bigger risk for biotechs and biopharma though is a delay in trials. That is unavoidable in many cases as the viral outbreak makes it harder to maintain trial integrity while also keeping staff, monitors, and patients safe. Also, the FDA will prioritize virus-related trials and reallocate resources, PDUFA dates can no longer be met, and new trial studies may not receive timely approval, and be able to recruit or retain. This can potentially delay multiple biopharma programs by at least three months, pushing progress into the second half.

However, it must be acknowledged that delay in programs, the biggest risk for biotechs, will not build into an existential issue and biotechs will come out of this crisis almost whole. At this point, one cannot say that with great conviction for several sectors of the economy.

There also are unique advantages that benefit biotechs. The group is mostly insulated from the risks of an earnings decline. They will not face a meaningful demand falloff or even the risk of permanently lost demand. On the contrary, biotechs may even benefit from COVID-19 activity as antivirals and vaccine research remain the focus. A few companies in this area include Gilead (GILD), Regeneron Pharmaceuticals (REGN), Moderna (MRNA), Novavax (NVAX), Vir Biotechnology (VIR), and Biontech (BNTX).

A Silver Lining

The situation is really bad. But it's not the end.

There's a lot we don't know about the path of the outbreak and the final cost on the economy, but we still know some things.

The viral outbreak has a shelf life and it can likely peak by mid-April, judging by the Chinese experience. That peaking will be a market relief. But the stock market may anticipate it and begin to strengthen earlier.

We also know there will be a gigantic pent-up demand. And we also know there's a huge stimulus of 0% rates. Besides, we also know there will most likely be a $1 trillion to $3 trillion of federal spending stimulus by the time all rescue packages and bailouts are finished.

The stock market already is reflecting a bad economic scenario. The broader market has declined over ~32%, larger cap biotechs ~26%, and healthcare 24%. It's a brutal selloff. And it's a forward payment on what's still to come. The really bad things haven't happened yet. They will start happening as the death rate rises rapidly, the healthcare system is overwhelmed, unemployment claims surge, bailout requests increase, and businesses begin to file for bankruptcy. But much of it is already being discounted into the market. It's very likely the market can decline further in this deluge of negative news to emerge over the rest of the month, but one has to believe that we're through at least the bulk of the sell-off.

If the economic fabric is mostly preserved, one can hope for the rebound to be swifter as well then previous recoveries. That will mean third-quarter GDP growth can perhaps be better than the second quarter. And if that happens, it will still be a good opportunity for investors to accrue positive returns for the year.

Conclusion

The best-case scenario does not exist as the country has failed in implementing the first level of preemptive containment to significantly manage-down the disease. At this time, the viral outbreak has taken hold and all containment efforts are being aimed to slow down the virus spread and give the healthcare system a fighting chance to serve the most serious patients and not break down. Businesses and the population are moving fast now to get ahead.

The Federal Reserve has been brilliantly urgent on the task of keeping credit markets liquid and functioning. Although there's no guarantee that credit markets won't seize up, the Fed and the other major central banks recognize the gravity of the situation and appear to be ready to keep intervening. The government has meanwhile ramped up its efforts to get more virus testing available while lining up stimulus and bailout packages.

The financial markets have gone into a tailspin. If one was caught in this sell-off with a fully invested portfolio it has been a very difficult experience. But there's also light at the end of the tunnel, and the second half will provide an opportunity to recover. Healthcare will be damaged much less compared to many other sectors in the economy. The model portfolios of Prudent Healthcare, the Prudent Biotech, and the Graycell Smallcap are presently 25% to 30% invested. Lowering exposure remains a preferred strategy in what's undoubtedly a highly treacherous market.

However, it cannot be ignored that there's a lot of stimulus flowing into the market. When does the market believe the economy can win out? The crisis of confidence requires some positive news on the viral outbreak and that may come by early April. In the meantime, business recovery in China is happening rapidly as new infection rate has dropped. In the best-case scenario, the bear market will most likely end in May as the economy emerges from a recession potentially during the third quarter.

There are many healthcare companies that will continue to have their business mostly intact and promising prospects ahead. A few of the larger ones which can be considered at an appropriate time include Gilead Sciences, Vir Biotechnology, Moderna, Regeneron Pharmaceuticals, Momenta Pharmaceuticals, Vertex Pharmaceuticals (VRTX), Acceleron Pharma (XLRN), Quidel (OTC:QDEL), Luminex, Karuna Therapeutics (KRTX), Zai Lab (ZLAB), Kodiak Sciences (KOD), Neogenomics (NEO), Seattle Genetics (SGEN), and Biogen (BIIB).

The article was submitted on March 18 to Seeking Alpha.